Claim: The SBP has warned people that funds upwards of PKR 500,000 kept in bank accounts are not safe anymore.

Fact: This is false; the SBP never issued such a warning. A comment from a meeting of the Senate Standing Committee on Finance and Revenue has been falsely reported on. The central bank has said in a statement that deposits are safe under its system, that the Deposit Protection Corporation provides another layer of protection to account holders through insurance worth PKR 500,000, and that if a bank fails, the remaining amounts may still be recoverable once the said bank is “resolved through a regulatory assisted process”. Further, some comments by Senator Saleem Mandviwalla — the chairperson of the said Senate committee — have also been wrongly attributed to the SBP Deputy Governor Dr Inayat Hussain. And lastly, the legal insurance cover is not new.

On 4 October 2023, SAMAA TV ran a news bulletin (archive) claiming that the State Bank of Pakistan (SBP) has issued a “warning to account holders”, with the following text in its thumbnail on X, formerly known as Twitter:

“بینک کھاتہ دار خبر دار۔۔۔۔ ہوشیار 5 لاکھ روپے سے زیادہ کا بینک بیلنس محفوظ نہیں

[Bank account holders, beware! Bank balance of over PKR 500,000 is not safe anymore]”

The digital desk for SAMAA TV’s English website published an article on 4 October titled, “State Bank warns you could lose your deposits in banks.” However, its headline has now been revised to state, “Deposits only up to 500,000 rupees have legal cover: warns State Bank.”

Fact or Fiction?

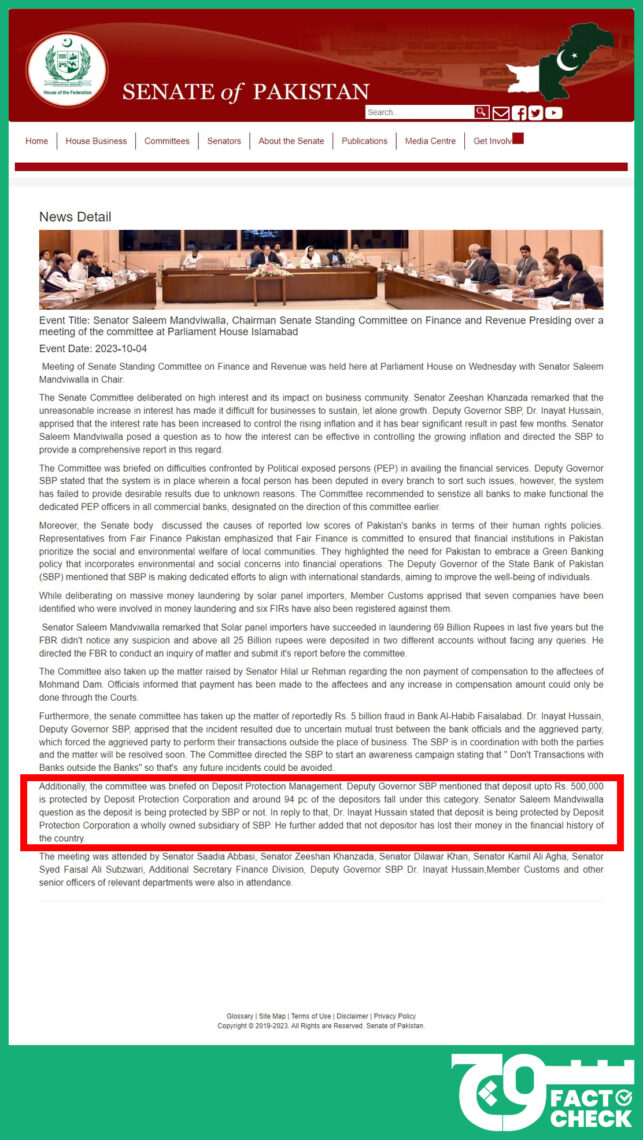

Soch Fact Check looked up reports pertaining to such a statement issued by the SBP but could not find any. However, we found that the Senate Standing Committee on Finance and Revenue had called a meeting on 4 October that was headed by its chairperson, Senator Saleem Mandviwalla, and included officials of the SBP and the Federal Board of Revenue (FBR).

A news release (archive) published on the website of the Senate of Pakistan states:

“The committee was briefed on Deposit Protection Management. Deputy Governor SBP [Dr Inayat Hussain] mentioned that deposit up to Rs. 500,000 is protected by Deposit Protection Corporation and around 94 pc of the depositors fall under this category. Senator Saleem Mandviwalla [questioned if] the deposit is being protected by SBP or not. In reply to that, Dr Inayat Hussain stated that [deposits are] being protected by Deposit Protection Corporation a wholly owned subsidiary of SBP. He further added that [no] depositor has lost their money in the financial history of the country.”

A report (archive) from the 5 October morning quotes Dr Hussain as saying that account holders’ funds “had legal protection worth [PKR] 500,000 under the Deposits Protection Corporation (DPC)”, that the previous limit was PKR 250,000, and that “the said amount limit fully covers 94 per cent of the depositors under the SBP subsidiary DPC”.

“All scheduled banks operating in the country were required to be members of the DPC to ensure the deposits in the banks come under the umbrella of the deposit protection mechanism,” according to the SBP official, the report added.

Another report (archive) states that 94% of the depositors fell under the category of people with under PKR 500,000 in their bank accounts.

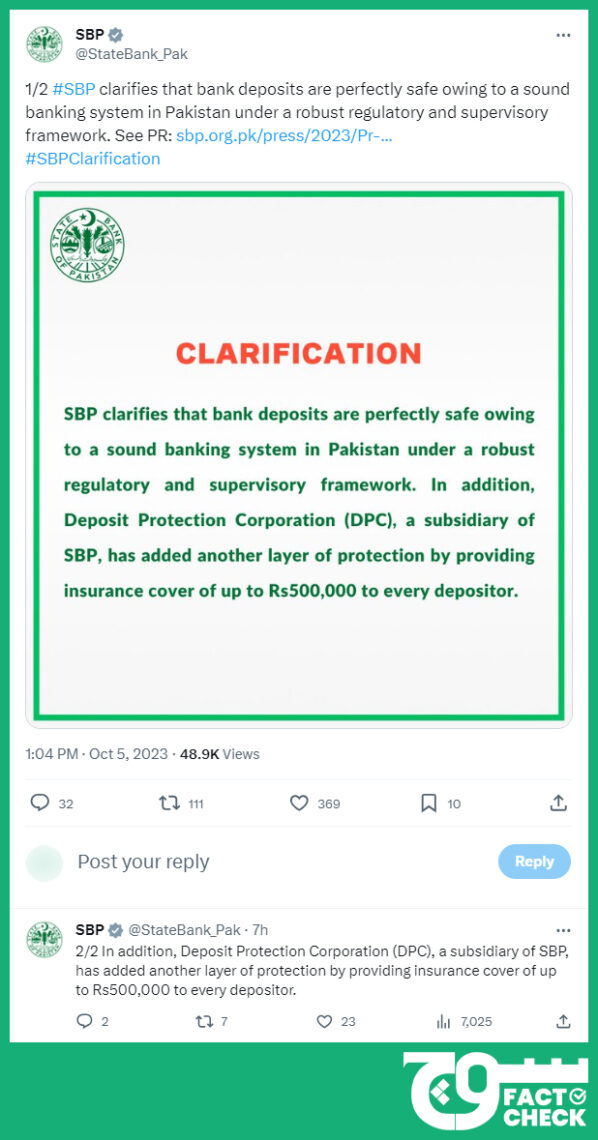

On 5 October, the State Bank of Pakistan itself tweeted out a clarification (archive) on X, saying, “SBP clarifies that bank deposits are perfectly safe owing to a sound banking system in Pakistan under a robust regulatory and supervisory framework.”

1/2 #SBP clarifies that bank deposits are perfectly safe owing to a sound banking system in Pakistan under a robust regulatory and supervisory framework. See PR: https://t.co/zLD1B94RdO#SBPClarification pic.twitter.com/d6O2hu9Dun

— SBP (@StateBank_Pak) October 5, 2023

“In addition, Deposit Protection Corporation (DPC), a subsidiary of SBP, has added another layer of protection by providing insurance cover of up to R$500,000 to every depositor,” it wrote.

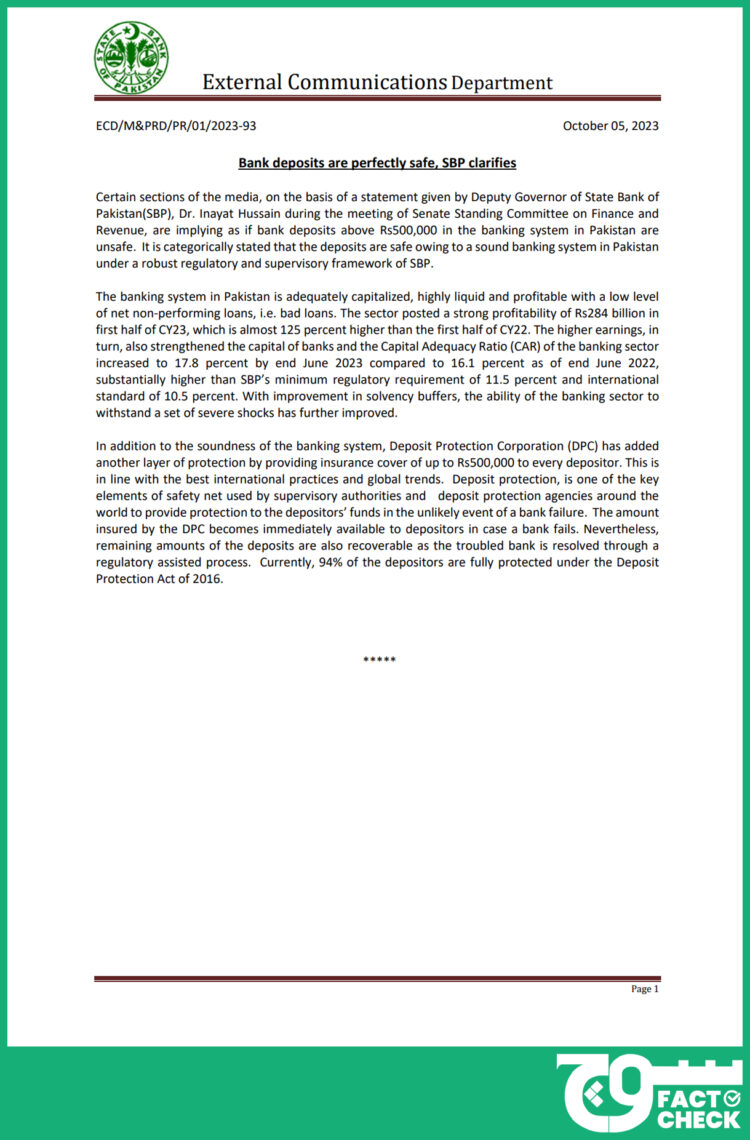

The SBP also linked a press release by its External Communications Department. “Certain sections of the media” published and aired misleading information, it noted.

It added, “It is categorically stated that the deposits are safe owing to a sound banking system in Pakistan under a robust regulatory and supervisory framework of SBP.”

“Nevertheless, remaining amounts of the deposits [in case of bank failure] are also recoverable as the troubled bank is resolved through a regulatory assisted process,” the press release said.

Virality

SAMAA TV posted the tweet in question at 11:03 PM on 4 October 2023. At 2:40 PM on 5 October 2023, it posted — and subsequently deleted within minutes, hence no archive available — another video captioned, “SBP debunks misinformation! @StateBank_Pak says #banks are well-capitalized, highly liquid, and profitable, with low non-performing loans @syedrizwanamir1 #SamaaTV”

A few minutes later, at 2:54 PM, after deleting the aforementioned tweet, it posted (archive) a thread with no video. In both, it said the SBP debunked “misinformation” peddled by the media while it was itself one of the first channels to run the false claim on 4 October 2023.

SAMAA TV posted multiple videos on its Facebook page that are available here, here, and here; they raked in over 3.4 million views, 57,000 reactions, 40,000 shares, and 5,700 comments, 57,000 views, 1,000 reactions, 375 shares, and 147 comments, and 22,000 views, 436 reactions, 118 shares, and 14 comments.

The channel shared the same on Instagram here and here, gaining upwards of 251,000 and 83,700 views.

We found the claim here, here, here, here, and here on Facebook, here and here on Instagram, and here, here, and here on X.

The SAMAA TV bulletin was shared here, here, here, and here on Facebook.

Multiple media outlets also published the false claim here, here, here, here, here, here, and here.

On the other hand, Facebook user ‘Ahmad Yousafzai’ made a post that went a step further to claim the SBP’s deputy governor had said a plan to change the policy to safeguard funds over PKR 500,000 can only happen when all the borrowed money is returned and the SBP acquires a large amount of money.

The Facebook user also included a video in their post, in which another person says, “[To] all those Pakistanis who have kept their money and funds in bank accounts: in case a bank goes bankrupt, you won’t get a single rupee back. This statement has been given by the State Bank’s deputy governor, who said any bank that has people’s, Pakistanis’, public’s money and that bank goes bankrupt, then that is a matter between the bank and the people, the government will not question or investigate any bank and it’s not a matter of the government. The State Bank will not question that bank either. This is the statement given by the State Bank’s deputy governor to the Senate Standing Committee.”

The video also includes screenshots of what appears to be a Geo News bulletin, which actually features a brief comment by Senator Saleem Mandviwalla, not Dr Hussain, the SBP’s deputy governor.

Conclusion: This is false; the SBP never issued such a warning. A comment from a meeting of the Senate Standing Committee on Finance and Revenue has been falsely reported on. The central bank has said in a statement that deposits are safe under its system, that the Deposit Protection Corporation provides another layer of protection to account holders through insurance worth PKR 500,000, and that if a bank fails, the remaining amounts may still be recoverable once the said bank is “resolved through a regulatory assisted process”. Further, some comments by Senator Saleem Mandviwalla — the chairperson of the said Senate committee — have also been wrongly attributed to the SBP Deputy Governor Dr Inayat Hussain. And lastly, the legal insurance cover is not something new.

Background image in cover photo: @StateBankPakistan

To submit an appeal on our fact-check, please send an email to appeals@sochfactcheck.com