Claim: Digital transfers “will now take 2 hours”, according to the State Bank of Pakistan (SBP).

Fact: The SBP has clarified that “all digital fund transfers are made on [a] real time basis” and people “receive funds in their accounts almost instantly”. The requirement of a two-hour cooling period was first introduced in 2023 and is only applicable “on the usage/cash-out of funds received in branchless banking wallets/accounts”.

On 22 September 2025, Facebook page ‘Scroll Pakistan’ posted (archive) a claim stating, “It will now take 2 hours to transfer digital funds.”

The accompanying caption reads as follows:

“The Governor of the State Bank announced in the Finance Committee that a two hour window has been introduced for digital fund transfers. This allows customers to report potential fraud within that period and have the transaction stopped. All banks are now required to notify customers whenever a transfer is initiated from their account, clarifying that the amount will only be moved after two hours. If a bank chooses to process a transfer immediately and fraud occurs, the bank will be responsible for reimbursing the customer.

“This two-hour delay has been implemented due to a rise in fraudulent transactions, many of which involve small amounts that often go unnoticed by investigative agencies. The time window ensures customers have the opportunity to act promptly if they are targeted by fraud.”

Besides posts on social media, the claim was shared in an Abbtakk News bulletin and in an article by the Times of Karachi.

It was also shared in a report by the state-run Associated Press of Pakistan (APP) about the Sargodha Chamber of Commerce and Industry (SCCI) welcoming the “decision to introduce a two-hour delay in digital fund transfers”.

Fact or Fiction?

Soch Fact Check reviewed the SBP’s social media accounts, WhatsApp channel, and official website to see if there was such a development.

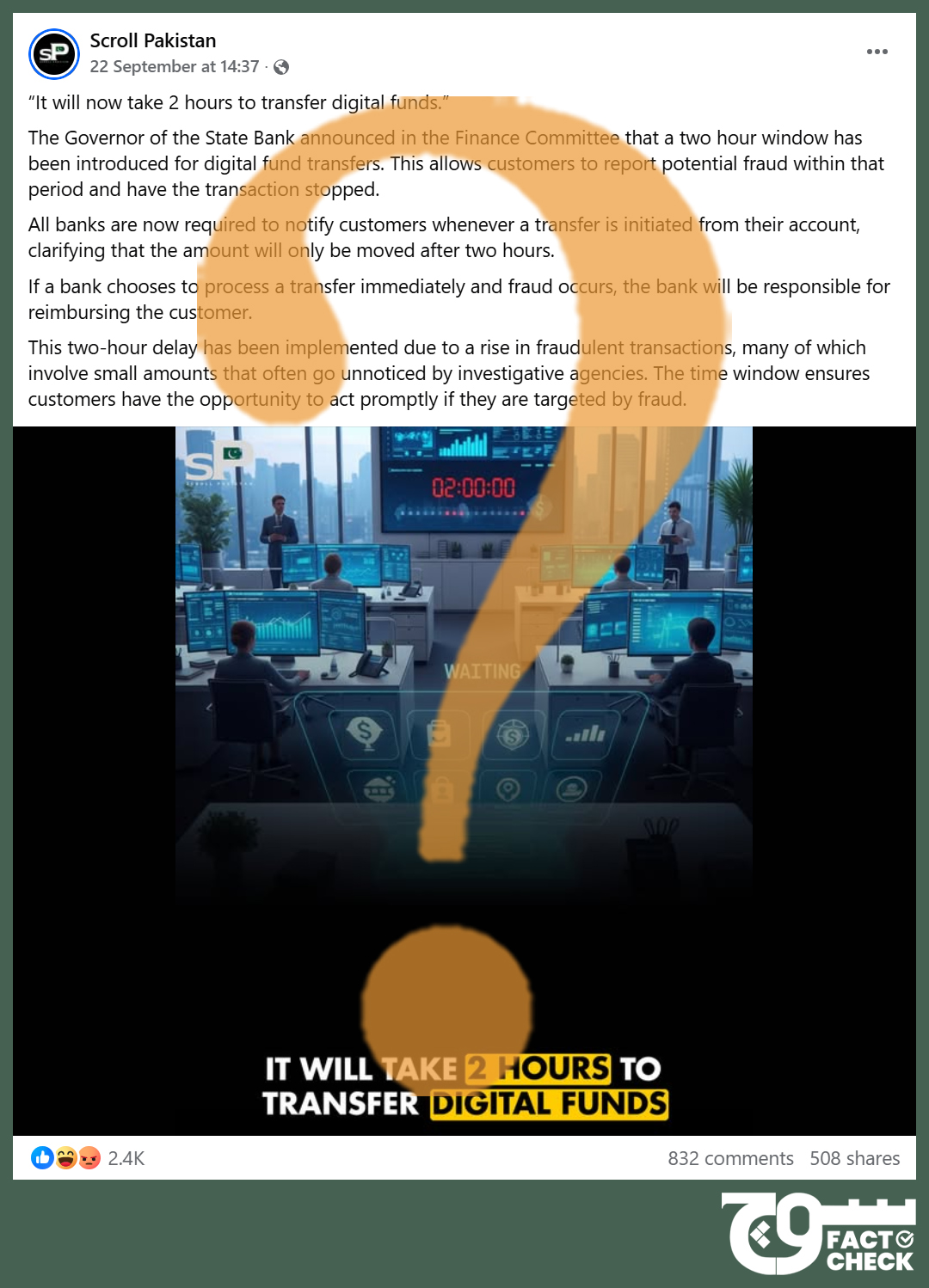

We came across the central bank’s clarification, available on its website, as well as statements in English and Urdu on its Facebook page and on X (formerly Twitter) here.

According to the statement, “It is clarified that all digital fund transfers are made on [a] real time basis and the beneficiaries receive funds in their accounts almost instantly.”

The SBP underscored that the two-hour cooling period is “applicable only on the usage/cash-out of funds received in branchless banking wallets/accounts”. It added, “While the funds in the branchless banking wallets/accounts are also received instantly, the cash-outs, on-line (sic) purchases or mobile top-ups against these funds can be made after the two (02) hours cooling period”.

Moreover, the said requirement was first introduced in April 2023, according to the statement, which added that this was because branchless banking accounts are subjected to comparatively simpler “customer due diligence requirements”, which is why “they have greater probability of use in fraudulent transactions”.

“The two-hour cooling period allows sufficient time [for] the customers to report any fraudulent transactions to their banks,” it said. “The cooling period instructions issued two and half years back have worked smoothly and proved to be a robust check against fraudulent transactions.”

Conclusively, it means that the news reports and social media posts being fact-checked are misleading. The SBP highlighted that the two-hour cooling period only applies when cash is withdrawn from branchless banking wallets and accounts, when online purchases are made, and when mobile top-ups — or recharge — are bought. This requirement, too, was announced two years ago and is, therefore, not recent.

Virality

Soch Fact Check found viral Facebook posts here, here, here, here, and here.

Daily Times also posted a report, which was shared here on Facebook.

On Instagram, the claim was shared here, here, here, here, and here.

A YouTube short, likely generated using artificial intelligence (AI) considering its voiceover and visuals, was also posted on 25 September 2025.

We also found the claim posted on different websites here, here, and here; the content in the first of the three appears to have been edited but the page retains its headline.

Conclusion: The SBP has clarified that “all digital fund transfers are made on [a] real time basis” and people “receive funds in their accounts almost instantly”. The requirement of a two-hour cooling period was first introduced in 2023 and is only applicable “on the usage/cash-out of funds received in branchless banking wallets/accounts”.

Background image in cover photo: Aqeel Ahmed Zia

To appeal against our fact-check, please send an email to appeals@sochfactcheck.com